Air Canada is finalizing plans to suspend most of its operations, likely beginning Sunday, as talks with the pilot union are nearing an impasse over “inflexible” wage demands, the country’s largest airline said on Monday.

Air Canada and its low-cost subsidiary, Air Canada Rouge, operate nearly 670 flights daily. Unless they reach a settlement with the union, the shutdown could affect 110,000 passengers daily, causing widespread disruptions.

The airline’s pilots have been pushing to close the salary gap with their U.S. peers, who managed to strike lucrative labor deals in 2023 amid pilot shortages and strong travel demand.

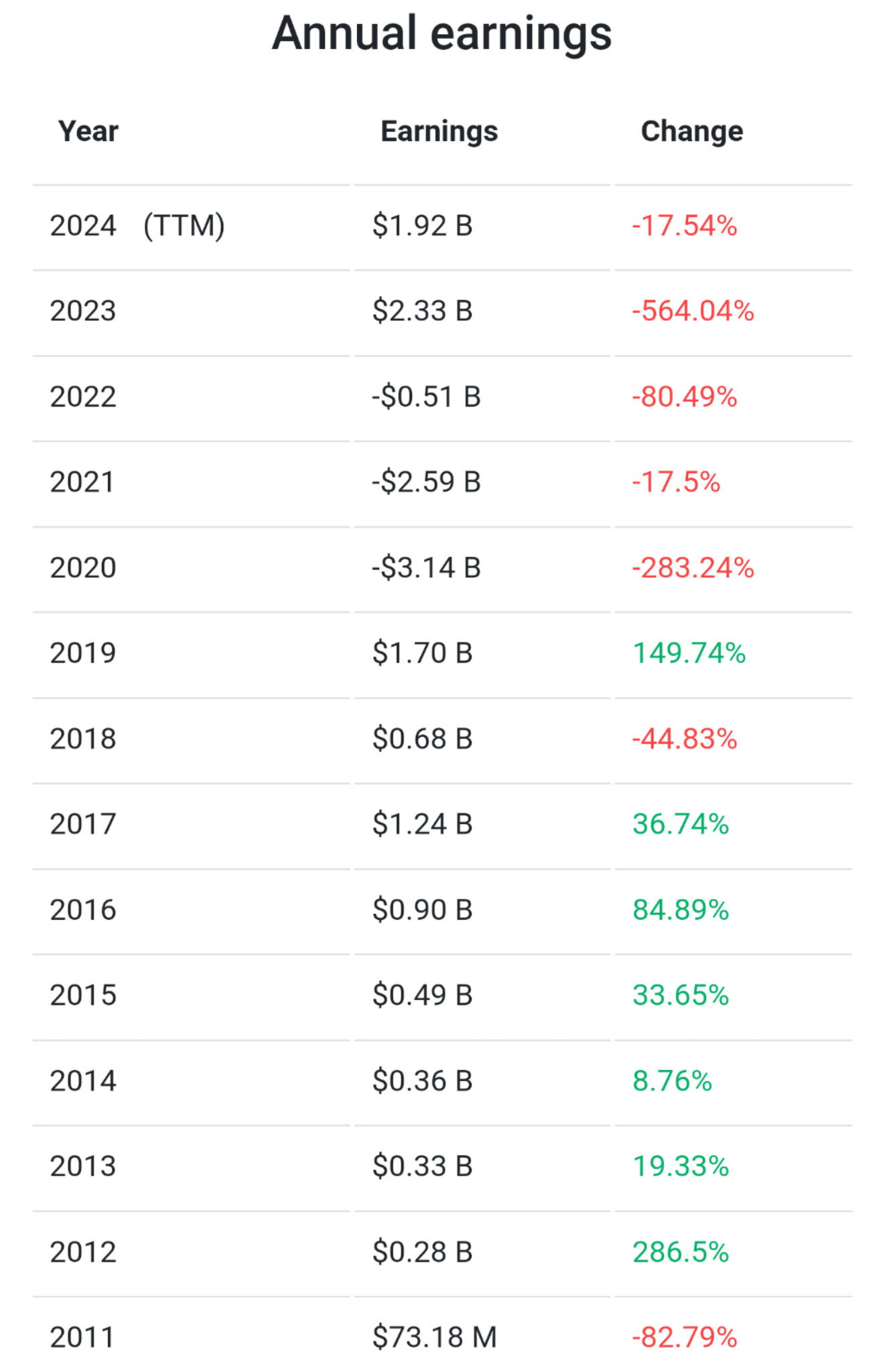

You’re right. I will post this to get you off my nuts. Based on their reporting, it does actually look like earnings are down. Does this account for stock buybacks and all the shady things corporations do these days though? I don’t know. Let’s look at CEO pay while we’re at it.

How is -0.5B -> 2.33B a -564% change?

Because percent change uses the previous value in the denominator, which here was negative. (2.33- -0.5)/(-0.5) = about -5.66, or -566%. What number do you think would make more sense?

I agree that’s how math works, but by reporting a negative percentage with it colored red is misleading at best. Perhaps a better metric would be +/- |(percent change)| where + indicates profit growth and and - indicates profit reduction?

Yeah I’ll agree that on its own it’s not a good measure because of situations like this.