Let’s first turn to the obvious negatives. The Trump idea is an admission that he and pretty much everyone are unserious about addressing the housing unaffordability problem because too many powerful players benefit from it. The most obvious remedy is to build more middle/lower middle class residences in high cost areas. But right away, that runs hard into NIMBYism: all those well off with their tony houses don’t want the servant classes or even dull normals living nearby and possibly harming their property prices.

… the popular freely-refinancable (as in no prepayment penalty) 30 year fixed rate mortgage is a very unnatural product and is found in comparatively few advanced. economies. On paper, it puts the interest rate risk on the lender. If rates drop, borrowers refinance, taking the loan away from creditors just when taking the risk of longer-dated loans is paying off. There are many ways to better share the interest rate risk, such as barring refis for the first five to seven years of a mortgage, or having interest rates float subject to a floor and ceiling. I had that sort of product in the early 1980s and was very happy with it. You can pencil out what your worst-case mortgage costs might be and benefit with no expenditure of effort if interest rates fall.

So why is this supposedly borrower-favoring feature, of the “freely refinancable” fixed rate mortgage, actually not good for borrowers? Because that option is NOT free! Not only do borrowers pay fees when they refinanace, but lenders have succeeded in structuring refis so that roughly 2/3 of the economic benefit of the refi is captured by financiers, not by the homeowner.

A related bad feature of the refinancable 30 year mortgage is that it increases systemic risk. Mortgage guarantors Fannie and Freddie have to hedge the refi risk. That hedging is pro-cyclical on a systemically disrupting scale.

…

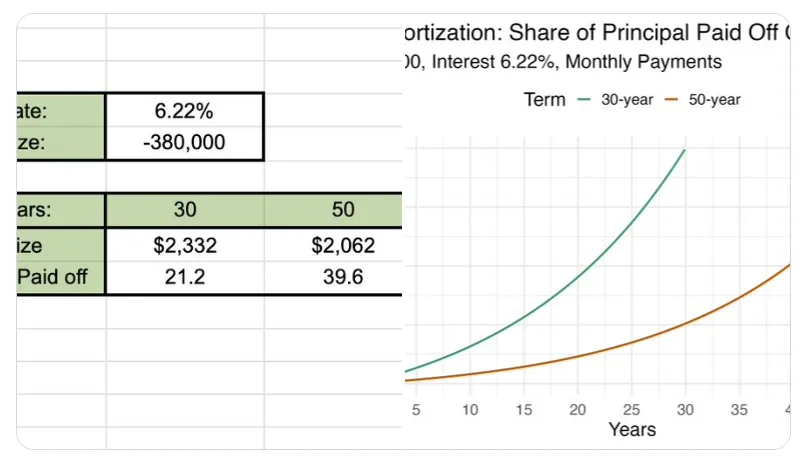

50 year mortgages, compared to a 30 year obligation have more of their payments over their life in interest. That means in a refi more total interest savings. That means even more in fee extraction by middlemen! More critically, it also means much greater pro-cyclical hedging action, and thus an even bigger increase in systemic risk, assuming that there actually was consumer receptivity to this bad idea…

The simple fact of that matter is that homes are too fucking expensive. Yes, a 50 year mortgage will drop your monthly payments by a significant margin (maybe 15ish percent) increasing affordability for the long term. However, this will only serve to prop up already inflated housing prices. The problems with that should be readily apparent.

A) if your house is twice as expensive as it should be, your payments will be twice as expensive at it should be. Thanks for the extra 15% off a month, but that still doesn’t get payments to anywhere near as affordable as it would be if housing was more available and, thus, cheaper. It would be better to forgo that 15% monthly payment decrease by extending your mortgage (and massively increasing interest), and instead see a 10% market price decrease and keep your 30 year mortgage and end up still paying less overall.

B) The biggest hurdle for any prospective home buyer is the initial hurdle, the down payment. You have to be able to pay for your current housing (be it mortgage or rent or whatever) and other necessities while also setting aside money on the order of tens of thousands to afford just the down payment on a house to even qualify for the loan. For even a modest home in my area, the lowest on market currently is asking ~175,000 for under 900 sq ft. 20% down for that would be 35k that you need to have saved before even considering buying the cheapest home in town. Extending the mortgage not only doesnt help you on this, it actually makes this hurdle worse. It makes mortgages easier to get for current home owner, in turn proping up the housing prices making it prohibitively expensive for renters and first time home buyers that dont have the equity in property to sell off to cover this down payment. And as the housing prices continue to inflate that 35k goal post just keeps moving further away every year while your money is sunk into your landlord’s pocket, who also increases rent as the market increases.

Prices needed to come down. Rents need to stop rising. And corporate real-estate investors need to be outlawed, or at least heavily regulated to prevent this absurd inflation. First time home buyers should be the first priority in real-estate and housing policies, not the last. We used to actively support them, but now we are more worried about boomers’ resale value and squeezing renters for every dime. It has to stop. Build more housing, more homes, more dense housing. Make competition for the landlords and give first time home buyers every advantage over investment buyers, particularly corporate investment buyers. Fund it with the American tax dollar and see the middle class rise back up. It’s really that easy, but they just wont do it becuase Daddy Warbucks wouldn’t like it.

There should be a progressive tax on anyone that owns a home but doesn’t live there. First home is nominal tax. Second home is double that. Third is quadruple. That’d fix housing and rent prices overnight.

And before anyone asks, yes same with apartment complexes. If the owner is forced to live in the complex, there’s an excellent incentive to keep it clean and maintained. And I’m specifically talking people, if a corporation owns a complex the top shareholder needs to be living there.

I dont think that would fix rents necessarily unless the taxes were particularly prohibitively. They’d just be incentivized and have an excuse to raise taxes more, seems like.

The actual numbers will likely not bear that out. Some back of the envelope math in this article and others has the payments dropping as little as $150 or $200 on a $2000 mortgage.

The problem is that rates for longer mortgages are naturally going to be higher as they are today. Most of the “gain” of stretching out the loan is eaten up by interest.

What does never seem to catch anyone’s eye though in general is…you can pay more than the minimum on your mortgage just like any other type of debt. If these products were available, I’d be slightly tempted to use one to lower my required monthly payments slightly while I saved up the principle to repay the loan in full.