The Economist reports: “China is ditching the dollar, fast”.

Over 30% of China’s trade in goods & services is now done in its own currency, RMB.

China settles over 50% of its total cross-border receipts (including financial flows) in yuan, up from less than 1% in 2010.

Xi pressed the button.

Xi pressed the button. death to the dollar

death to the dollarThE eCoNoMiSt MuSt Be PuSHiNg GoLd AnD cRyPto!

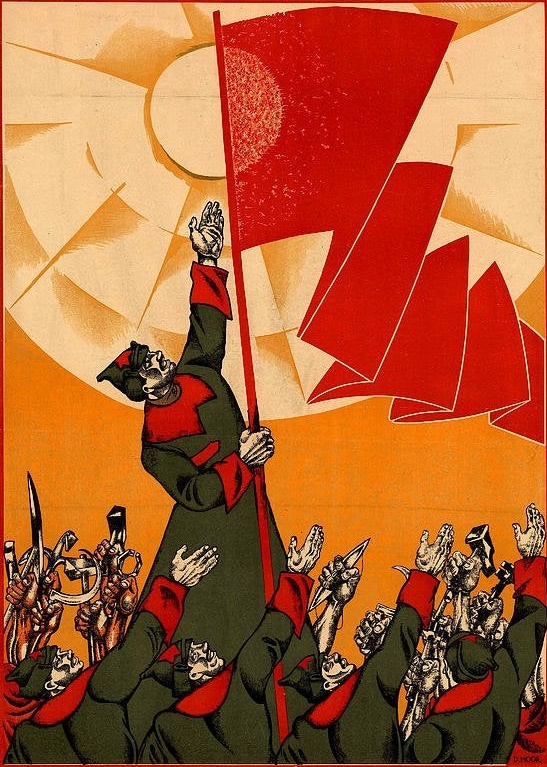

Didn’t Lenin call that rag “a journal which speaks for British millionaires”? Guess nothing’s changed in a century.

More, it started to come out in 1843, and in 1852 Marx said about it “the London Economist, the European organ of the aristocracy of finance, described most strikingly the attitude of this class.”

That sounds like… essentially, the same statement. (Though I think Lenin put it more succinctly, even if Marx’s phrasing was a better subtle insult to both the paper and its target audience.) Wow, that rag’s been essentially the same for nearly 200 years. How does a paper not fit to line a birdcage run for over 180 years straight, touting the same party line all that time? (The Trots are jealous, I’m sure.)

How does a paper not fit to line a birdcage run for over 180 years straight, touting the same party line all that time?

Because it always followed class interests of the capitalists, and they wouldn’t ditch such a useful thing.

Yeah, that’s about what I’d say as well. I was joking a bit there.

Marx statement is better because Lenin said “British millionaires” which is obviously outdated now, but Marx “aristocracy of finance” remain still relevant.

That’s a good point.

BDS America

🙂👍

honestly i hope not. strong/weak are dumb terms. hard/soft are better. china has been cooking the US by holding and hardening the US dollar for so long. if they’re dumping it back into yuan it’s going to soften the dollar which is what Trump admin wants

i hate that this might’ve been a part of a deal they worked out

The Dollar being used for international trade is literally the only reason the US economy doesn’t immediately collapse. China doing this is a good thing. It weakens the US.

Say more.

This article is talking about trade, not holdings. It is claiming that China is using the dollar less in trade and instead using other currencies. This makes the dollar less relevant, but doesn’t necessarily have an impact on the amount of dollars held by China.

couldn’t read the article because 404 error so wrote hope not / if

doing trades outside the dollar would soften it as well though. the impact would be minimal (going to take decades to de-dollarize the world) and just judging by the free-trade economist source they’re just writing shit because mad at trump over tariffs

edit: copy/pasting full article after ripping from vk. it’s just more evidence of China slowly becoming the world’s reserve currency.

China is ditching the dollar, fast - The Economist

China’s leaders sense an epic opportunity. Trump’s erratic trade policy, gaping fiscal deficits and threats to the independence of America’s Federal Reserve risk badly hurting the dollar. It has slumped 7% on a trade-weighted basis since January, and had its worst start to a year since 1973. By contrast, the yuan, has reached its highest level since Trump was re-elected. Foreign investors are piling in. So are many governments looking for dollar alternatives.

But even after America became the world’s largest economy, it still took decades for the dollar to achieve dominance. By that timescale, China is making surprisingly rapid progress. Its modest share of international payments has doubled since 2022. That is mostly thanks to changes at home. Increasing the yuan’s share in China’s own trade was an important step. Over 30% of China’s trade in goods and services is now done in its own currency (compared with 14% in 2019). It settles more than 50% of its total cross-border receipts (including financial flows) in yuan, up from less than 1% in 2010

What policymakers ultimately want is to create a stable circulation of yuan in and out of the country. That should boost the use of offshore yuan and improve foreigners’ ease of access to the currency. In May regulators told big banks that no less than 40% of trade-facilitation lending should be done in yuan. To increase circulation, officials want to encourage trade partners to accept China’s currency as payment. A major lure is offering them yuan liabilities. A study released in May found that after sanctions were imposed on Russia in 2022, Chinese banks switched nearly all of their new overseas lending out of dollars and into yuan (previously only 15% of loans were made in yuan), thereby tripling the stock of outstanding yuan debt

The government is pursuing the same strategy with its own balance-sheet. In the time since it began its internationalisation push, China has extended 4.5T yuan ($630B) in swap lines to 32 central banks, creating a global financial safety net that rivals the scale of the IMF’s. Only a fraction of such lines has actually been drawn on. The idea is to guarantee countries’ access to yuan in a crisis, giving them the confidence to borrow and buy in the currency.

China has also sorted its own financial plumbing. Now it can transact with others without touching the dollar system through a variety of means. These include the digital yuan and non-bank digital payments (QR code apps). CIPS, which bears similarities to SWIFT.

More than 1,700 banks have signed up to CIPS across the globe, up by a third since before the war in Ukraine. Transaction volumes rose faster than ever in 2024, up by 43% to 175T yuan ($24T).

Last year several billion dollars were said to have been transacted over a digital-currency network called mBridge, built by China with other central banks. An American official speaking in January said that although such payments were still economically insignificant, they had “already surpassed a threshold of geopolitical consequence”.

The coming months could prove crucial. Waning trust in the dollar and a supportive macroeconomic environment should boost China’s efforts. A lift in the stockmarket has given foreigners a financial incentive to hold yuan assets. Interest-rate cuts and deflation have pushed borrowing costs in the offshore market to below 2%, the lowest level since 2013. Firms, including foreign ones, are on track to issue a record amount of so-called “dim sum” yuan bonds this year.

China’s next safe move is opening up its onshore capital markets to its pals. Hungary issued about 5B yuan in so-called “panda bonds”, the largest single sovereign issuance to date. The FT reported that Russian energy firms had been given the go-ahead to issue yuan-denominated paper. Kenya may soon swap the dollar debts it owes to China into yuan. Brazil is mulling a new issuance and Pakistani officials have been in Beijing to pitch potential creditors.

I think the actual goal is to simply move trade outside the dollar system entirely. China is doubling down on bilateral swaps and using CIPS to establish financial systems completely outside western control. The value of the dollar relative to yuan is not that important because global financial system itself is bifurcating between BRICS and G7.

As the US continues to push for increasingly more extractive trade arrangements, counties outside the west will continue to shift trade away from the US and as a result they no longer need to hold the dollar.

This will harsh the yuan relative to the dollar long term, right? Should I buy Yuan?

Yes, why not speculate on the winning side? But anyway, I don’t know the process of buying Chinese financial assets, don’t even know if it’s possible.

China has capital controls. The usual market logic doesn’t necessarily apply. If they decide a strong Yuan is not in their best interest they may deliberately weaken it.

There are plenty of stable investments in China though. The one i would stay away from is real estate probably.